Porter’s five forces model helps in accessing where the power lies in a business situation. Porter’s Model is actually a business strategy tool that helps in analyzing the attractiveness in an industry structure. It let you access current strength of your competitive position and the strength of the position that you are planning to attain.

Porters Model is considered an important part of planning tool set. When you’re clear about where the power lies, you can take advantage of your strengths and can improve the weaknesses and can compete efficiently and effectively.

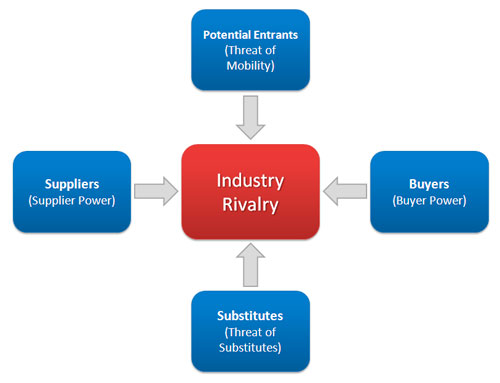

Porters model of competitive forces assumes that there are five competitive forces that identifies the competitive power in a business situation. These five competitive forces identified by the Michael Porter are:

- Threat of substitute products

- Threat of new entrants

- Intense rivalry among existing players

- Bargaining power of suppliers

- Bargaining power of Buyers

-

Threat of substitute products

Threat of substitute products means how easily your customers can switch to your competitors product. Threat of substitute is high when:

- There are many substitute products available

- Customer can easily find the product or service that you’re offering at the same or less price

- Quality of the competitors’ product is better

- Substitute product is by a company earning high profits so can reduce prices to the lowest level.

In the above mentioned situations, Customer can easily switch to substitute products. So substitutes are a threat to your company. When there are actual and potential substitute products available then segment is unattractive. Profits and prices are effected by substitutes so, there is need to closely monitor price trends. In substitute industries, if competition rises or technology modernizes then prices and profits decline.

-

Threat of new entrants

A new entry of a competitor into your market also weakens your power. Threat of new entry depends upon entry and exit barriers. Threat of new entry is high when:

- Capital requirements to start the business are less

- Few economies of scale are in place

- Customers can easily switch (low switching cost)

- Your key technology is not hard to acquire or isn’t protected well

- Your product is not differentiated

There is variation in attractiveness of segment depending upon entry and exit barriers. That segment is more attractive which has high entry barriers and low exit barriers.

Some new firms enter into industry and low performing companies leave the market easily. When both entry and exit barriers are high then profit margin is also high but companies face more risk because poor performance companies stay in and fight it out. When these barriers are low then firms easily enter and exit the industry, profit is low. The worst condition is when entry barriers are low and exit barriers are high then in good times firms enter and it become very difficult to exit in bad times. -

Industry Rivalry

Industry rivalry mean the intensity of competition among the existing competitors in the market. Intensity of rivalry depends on the number of competitors and their capabilities. Industry rivalry is high when:

- There are number of small or equal competitors and less when there’s a clear market leader.

- Customers have low switching costs

- Industry is growing

- Exit barriers are high and rivals stay and compete

- Fixed cost are high resulting huge production and reduction in prices

These situations make the reasons for advertising wars, price wars, modifications, ultimately costs increase and it is difficult to compete.

-

Bargaining power of suppliers

Bargaining Power of supplier means how strong is the position of a seller. How much your supplier have control over increasing the Price of supplies. Suppliers are more powerful when

- Suppliers are concentrated and well organized

- a few substitutes available to supplies

- Their product is most effective or unique

- Switching cost, from one suppliers to another, is high

- You are not an important customer to Supplier

When suppliers have more control over supplies and its prices that segment is less attractive. It is best way to make win-win relation with suppliers. It’s good idea to have multi-sources of supply.

-

Bargaining power of Buyers

Bargaining Power of Buyers means, How much control the buyers have to drive down your products price, Can they work together in ordering large volumes. Buyers have more bargaining power when:

- Few buyers chasing too many goods

- Buyer purchases in bulk quantities

- Product is not differentiated

- Buyer’s cost of switching to a competitors’ product is low

- Shopping cost is low

- Buyers are price sensitive

- Credible Threat of integration

Buyer’s bargaining power may be lowered down by offering differentiated product. If you’re serving a few but huge quantity ordering buyers, then they have the power to dictate you.

Michael Porters five forces model provides useful input for SWOT Analysis and is considered as a strong tool for industry competitive analysis.

Industry Analysis Example (Porter’s Five Forces and Complementors)

Wal-Mart

Here is a very brief example of an Industry Analysis for the Cases using Wal-Mart, specifically Wal-Mart’s competition in the consumer retail industry and not in the industries where it competes. Remember, that you are concerned with where Wal-Mart is positioned in the industry relative to the respective industry forces.

• Potential Competitors: Medium pressure

o Grocers could potentially enter into the retail side.

o Entry barriers are relatively high, as Wal-Mart has an outstanding distribution systems, locations, brand name, and financial capital to fend off competitors.

o Wal-mart often has an absolute cost advantage over other competitors.

• Rivalry Among Established Companies: Medium Pressure

o Currently, there are three main incumbent companies that exist in the same market as Wal-Mart: Sears, K Mart, and Target. Target is the strongest of the three in relation to retail.

o Target has experienced tremendous growth in their domestic markets and have defined their niche quite effectively.

o Sears and K-Mart seem to be drifting and have not challenged K-Mart in sometime.

o Mature industry life cycle.

• The Bargaining Power of Buyers: Low pressure

o The individual buyer has little to no pressure on Wal-Mart.

o Consumer advocate groups have complained about Wal-Mart’s pricing techniques.

o Consumer could shop at a competitor who offers comparable products at comparable prices, but the convenience is lost.

• Bargaining Power of Suppliers: Low to Medium pressure

o Since Wal-Mart holds so much of the market share, they offer a lot of business to manufacturers and wholesalers. This gives Wal-Mart a lot of power because by Wal-Mart threatening to switch to a different supplier would create a scare tactic to the suppliers.

o Wal-Mart could vertically integrate.

o Wal-Mart does deal with some large suppliers like Proctor & Gamble, Coca-Cola who have more bargaining power than small suppliers.

• Substitute Products: Low pressure

o When it comes to this market, there are not many substitutes that offer convenience and low pricing.

o The customer has the choice of going to many specialty stores to get their desired products but are not going to find Wal-Mart’s low pricing.

o Online shopping proves another alternative because it is so different and the customer can gain price advantages because the company does not necessarily have to have a brick and mortar store, passing the savings onto the consumer.

• Complementors: Low pressure

o One complementor that exists for Wal-Mart is Sam’s Wholesale Clubs. Although the same company owns this, it complements Wal-Mart by offering the same products in wholesale form, making the company more profitable.

o Suppliers of goods need to have innovative products to attract customers.

o For the most part, complementors do not affect Wal-Mart’s business model

Simple & easy to understand ………… Thanks u !!!!

thumbs up for mr porter. he simplified the business environment

great stuff made so simple. cheers!

hi

could you say your reference for this subject?

regards

perfect one….

Thanks a lot for your lesson . fantastic

simple and easy to understand, thats great

The model can be effective even though it has it’s short comings. My interest is on the possibility of applying Porters model in a public sector, where government provide services for free.

understandable thanks

hi! you have made our studying and understanding simple, thank you for that, but what is your reference?

Thank you this is helpful.

I have question.

can you give me an example in Porter’s five forces model on public sector?

well explained with good examples. walmart case is very relevant to this

Thanx Mr Porter! Very easy one

it really written in a simple and understandable format even a layman may have got it .Thanks for such a nice stuff.

it really written in a simple and understandable format, even a layman may have got it .Thanks for such a nice stuff.